Content

Make use of it alongside almost every other offers arrangements, for example an excellent 529 otherwise a custodial membership, to offer your son or daughter a strong monetary basis. Students born just after December 31, 2024, and you can prior to January step one, 2029,(while the U.S. owners which have Public Defense quantity) qualify. Some family members may be automatically enrolled if the Internal revenue service produces an enthusiastic membership on their boy’s account having fun with taxation info. If not, parents or guardians will have to affect open an excellent Trump Membership to result in the newest $step one,100000 regulators share. Which brings an excellent “sweet spot” on the Salt deduction between $two hundred,one hundred thousand and you may $five hundred,100000 of money, based on other specifications in the bill, CPA John McCarthy authored within the an article recently. Here are a few of your secret changes of Trump’s regulations to learn to possess 2025, and exactly how the new position can impact their taxation.

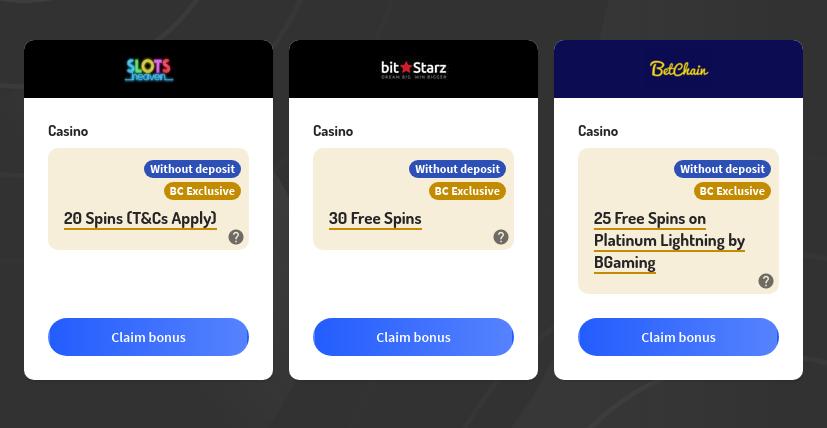

Unlocking Income tax Savings to have Distilleries: The efficacy of Costs Segregation | no deposit Mr Green for existing customers

You will find a supplementary $step one,000 contribution obtainable in each other tax decades of these 55 otherwise more than. A different way to possibly reduce your taxable earnings out of a plus is always to subscribe a vintage private old age account (IRA). For 2025, you could potentially lead as much as $7,100000 to a classic IRA (along with $7,one hundred thousand when you’re 50 otherwise elderly). You could subtract the individuals efforts from your own pre-tax income, and this reduces the money you happen to be taxed to your and helps stabilize extent added by the incentive. Taxation is withheld from your own typical shell out centered on information your give on your own Form W-cuatro, together with your relationship status and quantity of dependents.

- The Senate and House types of the statement would make the newest TCJA individual taxation cost long lasting and you may do customize the inflation changes mechanism to own private taxation brackets.

- Basically, 529 preparations render years-dependent profiles, which start with much more equity publicity in the beginning in the a good kid’s lifestyle then be more traditional as the college or university nears.

- In the the brand new statement, some of the taxation cuts is actually once again set-to expire, generally after the latest government will leave workplace.

- A resort bartender and make $forty-five,100 as well as $5,one hundred thousand inside the information gets back the federal fees withheld off their tips.

- With this due dates, certain experts say what the law states is anticipated to sluggish the new energy from clean time use and enhance the cost barrier to own solar and EV improvements.

Change is short term

Of several members of the family advocates state such alter threaten to push many to your food low self-esteem, especially more mature experts and families within the large-jobless components. The new laws reduces Medicaid funding because of the roughly 18% more 10 years — from the $600 in order to $800 billion depending on the Congressional Funds Place of work (CBO) — as a result of a combination of no deposit Mr Green for existing customers the fresh qualifications limits, resource examination, and you can work standards. With the deadlines, some experts say the law is anticipated so you can sluggish the brand new impetus from brush opportunity adoption and you may enhance the prices hindrance to have solar and EV enhancements. Congress enacted the huge bill using the budget reconciliation procedure. You to definitely strategy allows an individual party, in this case, Republicans, in order to accept specific laws and regulations which have a straightforward vast majority. Money and you can do just fine for the good professional advice for the investing, taxation, old age, private fund and much more – directly to your own elizabeth-post.

Timeline of Interest

However with full added bonus decline into 2025, one “rehab” step merely turned into far more appealing. The newest supply and produces an excellent Sec. 139K, which excludes of earnings scholarships for the certified supplementary or elementary training expenditures from qualified students. Underneath the act, Treasury can also be create Trump accounts for people that it refers to while the eligible as well as for and that no Trump membership was already created. The fresh AICPA has authored maps comparing income tax and private financial believed terms of the act with latest rules (100 percent free webpages registration required). The top Beautiful Costs’s $step 1,100 child bonus will remind household to keep very early to have its kids.

Starting in 2030, the new Sodium deduction cap tend to return to help you its previous rules value out of $ten,100 for everybody filers ($5,000 for these hitched filing separately) forever. The new $10,one hundred thousand Salt cover assists offset an element of the almost every other taxation slices on the laws whilst limiting the fresh regressive effect away from a great a lot more nice Salt deduction limit to your delivery away from taxes paid. The fresh tax deductions to own overtime, info, the elderly, and you may automobile financing try briefly in effect from 2025 thanks to 2028. The greater big home income tax exemptionA income tax exclusion excludes certain income, funds, or even taxpayers of tax altogether.

No income tax to the car loan interest (Sec.

If the an organic crisis (a keen “Work from Jesus”) waits your own strengthening, you are welcome a tad bit more time for you to place it in-service. Workplaces, software development, sales structures, and you can parking garages do not qualify. But another facility used to make chairs, server pieces, otherwise packaged dining manage qualify. For many who number music otherwise voice on the You.S., anyone can deduct around $150,one hundred thousand of them costs quickly.

A few of the nuances of your own tipped supply as well as pertain right here, in addition to you to both the taxpayer and their mate you desire Personal Defense number to be considered, pros say. As well, overtime deductions only affect overtime pay as the laid out by Fair Work Standards Operate (FLSA) of 1938, says Karpchuk. On the One Larger Beautiful Statement in place, it’s hard to think a far greater time to buy rental assets.

Ideally, a simple modifications to the value of depreciation deductions to own formations otherwise full expensing for all structures create be a long-term component from tax law in the future reforms. Because of the cutting-edge laws and you will limited income tax advantages, Trump Membership try unlikely getting widely used to own rescuing. If your federal government extremely planned to generate preserving far more obtainable for taxpayers, it could change the challenging mess from offers account available today which have universal offers membership. The fresh AMT exclusion phaseout speed was also increased from a quarter below past rules so you can fifty percent of 2026 ahead, definition the newest exemption try reduced two times as punctual just after earnings is higher than the new tolerance.

- Taxpayers you may subtract as much as $ten,100 inside the attention to your car and truck loans for automobile make on the U.S., applicable to taxation years 2025 thanks to 2028.

- However, once accounting to own economic gains, after-income tax earnings to the bottom quintile develops by 0.5 percent inside 2034.

- The big Split IV try recorded inside the June 2005, and you will premiered to your September 13 of the same seasons.

- It topic is almost certainly not wrote, transmit, rewritten, otherwise redistributed.

- Including finance to a great 529 package, a taxation-advantaged family savings to have knowledge can cost you, wouldn’t reduce your taxable earnings.

In the 2025, companies are expected to use a short-term revealing means as the Form W-dos obtained’t but really provides a devoted package to have overtime shell out. Very might tend to be licensed overtime payment inside the Field 14 (Other) or possibly give an alternative declaration appearing your qualified overtime compensation. The brand new zero income tax on the overtime costs is actually included in the One to Big Stunning Expenses (as well as possibly called the Working Family Taxation Slices) one to President Trump signed to your laws inside the July 2025. The fresh laws produces an initial-of-its-type tax different for certain overtime shell out, productive while it began with taxation seasons 2025.

Notably, so it calculation excludes the expense of house as well as first things for example believed, framework, and investment. The new 24th seasons will be called, “Big Break x Good good,” and certainly will take place from the Horseshoe Bay Resorts west of Austin, Colorado. The fresh collection champion will get a mentor exclusion to your PGA Tour’s Good good Title, getting kept 2nd November at the Omni Barton Creek inside Austin.

Permits traders to rather lose taxable income in the seasons you to definitely and you may gain earlier use of cash flow. In the 2024 election campaign, President Trump promised he create eliminate all of the income taxes on the Public Security. The newest has just enacted One to Huge Beautiful Bill Operate (OBBBA) doesn’t come with so it provision, however, brings a different extra simple deduction for the elderly.

An entire deduction number might possibly be available to people who have upwards so you can $75,100 inside the modified modified revenues, and you may $150,100000 if partnered and submitting as you. Desire paid back on the a good funded the newest automobile would be allowable to own amounts as much as $ten,100000 from 2025 because of 2028, phasing out during the a great 20 percent price when income is higher than $one hundred,one hundred thousand to own solitary filers and you will $200,100 to have shared filers. The car must have been ultimately make in the united states to help you qualify for the brand new deduction. The newest OBBBA stretches and you may can make long lasting the new Section 199A ticket-due to deduction, that allows admission-due to advertisers so you can subtract 20 percent away from qualified team money whenever calculating nonexempt money.