Maximizing Forex Trading Profit: Strategies for Success

Forex trading, or foreign exchange trading, involves buying and selling currencies to capitalize on fluctuations in exchange rates. It offers opportunities to profit from market movements, but it also comes with risks. To navigate the complex world of forex trading successfully, traders need to employ effective strategies and techniques. In this article, we will delve into various aspects of forex trading profit, exploring strategies, risk management, and resources for success, including a recommended forex trading profit Trading Platform QA.

Understanding the Forex Market

The forex market operates 24 hours a day, five days a week, and is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock markets, which have specific trading hours, the forex market allows traders to react to news and economic events in real-time. It consists of a network of buyers and sellers exchanging currencies and is influenced by various factors including interest rates, economic indicators, and geopolitical events.

The Basics of Forex Trading

To start trading forex, it’s crucial to understand a few fundamental concepts. Currencies are quoted in pairs, such as EUR/USD (Euro to US Dollar). The first currency is the base currency, and the second currency is the quote currency. A trader will buy a currency pair if they believe the base currency will strengthen against the quote currency, and sell if they believe it will weaken.

Leverage in Forex Trading

One of the defining characteristics of forex trading is the use of leverage, which allows traders to control larger positions with a smaller amount of capital. This can magnify profits, but it also increases the risk of loss. Understanding how leverage works is vital for successful trading. For example, a leverage ratio of 100:1 means that for every $1 in your trading account, you can control $100 in the market. While this can lead to substantial profits, it can also result in significant losses if the market moves against your position.

Strategies to Increase Forex Trading Profit

Profitable forex trading often requires a disciplined approach and strategic planning. Here are several popular strategies that traders use to maximize their Forex profit:

1. Scalping

Scalping is a short-term trading strategy aimed at making numerous small profits throughout the day. Scalpers often hold positions for just a few minutes or seconds and rely on high leverage to amplify gains. This strategy requires a solid understanding of market mechanics and quick decision-making abilities.

2. Day Trading

Day trading involves opening and closing positions within the same trading day. Unlike scalping, which focuses on very short time frames, day traders may hold positions for hours or the entire day, looking to profit from intraday price movements. They tend to analyze short-term price trends using charts and technical indicators.

3. Swing Trading

Swing trading is a medium-term strategy where traders aim to capture price swings in the market over several days to weeks. This approach often requires a combination of technical analysis and fundamental analysis to identify potential trends and reversals. Swing traders look for optimal entry and exit points to maximize profit potential.

4. Position Trading

Position trading is a long-term strategy that can involve holding trades for weeks or months, focusing on fundamental analysis to assess economic trends that impact currency values. Position traders are less concerned with short-term volatility and may use a mix of technical and economic analysis to make trading decisions.

The Importance of Risk Management

No trading strategy can guarantee profits, which is why effective risk management is crucial in forex trading. Here are some key risk management techniques:

1. Setting Stop-Loss Orders

A stop-loss order is a predetermined price level set to automatically close a trading position to prevent further losses. By using stop-loss orders, traders can protect their capital and minimize risk.

2. Position Sizing

Understanding how much of your capital to risk on a single trade is vital. A common rule of thumb is to risk no more than 1-2% of your total trading capital on one trade. This approach helps to ensure that no single loss will significantly affect your overall account.

3. Diversification

Diversifying your trading portfolio by trading multiple currency pairs can reduce the overall risk. When one currency pair performs poorly, others may perform well, helping to balance potential losses and gains.

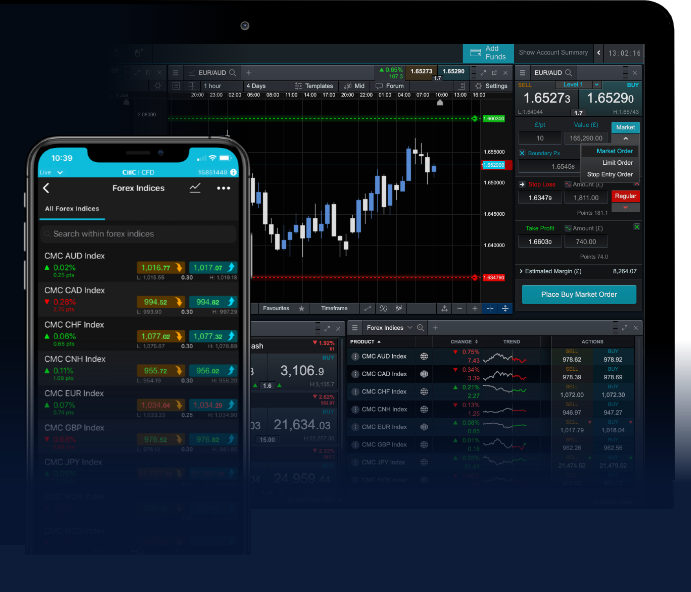

Utilizing Technology and Resources

Advancements in technology have transformed forex trading. Various tools and resources are available to help traders make informed decisions. Platforms often feature advanced charting software, real-time market data, and trading signals. Additionally, educational resources like webinars, tutorials, and trading communities can enhance a trader’s knowledge and skills.

Choosing a Trading Platform

Selecting the right trading platform is essential for successful forex trading. Many platforms offer valuable features such as user-friendly interfaces, extensive trading tools, and educational resources. Traders should consider factors such as fees, available currency pairs, and the platform’s reputation. A thorough review of platforms can help traders find the right fit for their needs.

Continuous Learning and Adaptation

The forex market is continuously evolving due to economic changes, political developments, and technological advancements. Staying informed is crucial for long-term success. Traders should dedicate time to learning about market trends, economic news, and new trading strategies. By continuously adapting to the market environment, traders can enhance their skills and improve their profit potential.

Conclusion

Forex trading offers significant profit potential, but it requires careful planning, disciplined execution, and effective risk management. By employing sound trading strategies, leveraging available resources, and committing to continuous learning, traders can capitalize on market opportunities and work towards maximizing their forex trading profit. Remember that success in forex trading does not come overnight; it requires patience, practice, and dedication to the craft. With the right mindset and approach, you can navigate the forex market successfully.